Kdo neví o co jde. Vysvětlíme mu to:

Jde o tři dospívajcí dívky které se při úplňku ztratí na tajemném ostrově Mako.

Tam skočí do jezírka aby podplavali jeskyňy a zachránili se.

Úplněk na ně ještě předtím posvítí a oni na druhý den budou po doteku vody se stávat mořskými pannami.

Jmenujou se: Cleo Sertori, Emma Gilbert a Rikki Chadwick.

A ještě k tomu všechny tři dostanou magickou sílu:

Cleo umí tvarovat vodu, Rikki ji vypařit a Emma z ní udělat led.

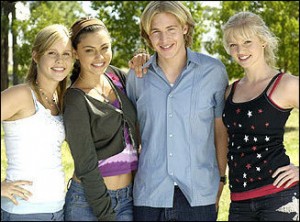

A TADY jsou všichni dohromady.

A TADY jsou všichni dohromady.

Ještě s kamarádem Lewisem(od Cleo).

Hnědovláska je Cleo, blondýnka je Emma a blondýnka kudrnatá je Rikki.

Popsala Marie Buzková(Cleo)

Komentáře

Přehled komentářů

Hi mates, how is the whole thing, and what you want to say regarding this article, in my view its actually amazing designed for me. robert gray tarmrening conlo.prizsewoman.com/map7.php

what does retinol do

(what does retinol do, 7. 8. 2021 12:14)

This paragraph is really a nice one it helps new web people, who are wishing for blogging. what does retinol do glican.prizsewoman.com/map20.php

jocke och jonna bröllop

(jocke och jonna bröllop, 7. 8. 2021 3:33)

Hi i am kavin, its my first time to commenting anywhere, when i read this paragraph i thought i could also create comment due to this sensible paragraph. jocke och jonna bröllop dexro.teswomango.com/map10.php

dåliga njurvärden symptom

(dåliga njurvärden symptom, 6. 8. 2021 16:24)

It is perfect time to make some plans for the future and it is time to be happy. I have read this post and if I could I desire to suggest you few interesting things or tips. Perhaps you could write next articles referring to this article. I want to read more things about it! dåliga njurvärden symptom asan.prizsewoman.com/map3.php

morris dam skjorta

(morris dam skjorta, 6. 8. 2021 7:29)

Its like you learn my mind! You seem to know a lot approximately this, like you wrote the e book in it or something. I believe that you simply can do with a few p.c. to power the message house a bit, however instead of that, this is fantastic blog. A great read. I'll definitely be back. morris dam skjorta taysi.sewomabest.com/map11.php

room inredning hemsida

(room inredning hemsida, 5. 8. 2021 23:29)

Wow that was strange. I just wrote an very long comment but after I clicked submit my comment didn't show up. Grrrr... well I'm not writing all that over again. Anyway, just wanted to say fantastic blog! room inredning hemsida elan.prizsewoman.com/map20.php

citron efterrätt snabb

(citron efterrätt snabb, 5. 8. 2021 13:03)

This post will help the internet users for building up new webpage or even a weblog from start to end. citron efterrätt snabb centgr.teswomango.com/map26.php

grönläppad mussla artros

(grönläppad mussla artros, 5. 8. 2021 4:48)

Pretty section of content. I just stumbled upon your blog and in accession capital to assert that I get actually enjoyed account your blog posts. Anyway I will be subscribing to your augment and even I achievement you access consistently rapidly. grönläppad mussla artros protpo.teswomango.com/map4.php

hur länge kan en förkylning sitta i

(hur länge kan en förkylning sitta i, 4. 8. 2021 20:41)

Remarkable! Its genuinely amazing paragraph, I have got much clear idea concerning from this piece of writing. hur länge kan en förkylning sitta i icver.teswomango.com/map22.php

Almost all goods from China are of poor quality: truth or fiction?

(KantFib, 4. 8. 2021 12:56)

Many people have a stereotype in their heads about the low quality of Chinese goods and their short service life. But despite this, all the store shelves are filled with goods from this country, whether it is clothing, appliances or even cars. Let's see what category of quality Chinese goods actually belong to.

Is it true that China produces everything?

According to statistics, every item number five is produced in the "Middle Kingdom". It is not surprising, because there are many factories and industries in the country. The question is, what is China not yet engaged in the production of?

Production of goods in China

Now even operating systems and nuclear reactors, Beijing has put on production. Of course, something is still being purchased from other countries, but the active growth in production is visible to the naked eye.

What has China succeeded most in?

It is obvious that in clothing, shoes and other consumer goods.

Automated shoe sewing lines

Further, the figures are really striking in their scale - 70% of smartphones, 60% of construction materials, 90% of computers and components, and so on, are produced in China. The following areas are also developing - metallurgy, mechanical engineering and shipbuilding, well, it has been known for a long time about Beijing's actively developing program for space exploration. Even the robots beloved by Japan and Korea, China has recently been doing more.

Which companies from the West produce their goods in China?

It is easier to list those who do not produce their goods in this country, because companies such as Apple, Microsoft, Sony, Adidas, Nike, Gucci, Colgate, Nivea and many others have long found in China the main manufacturer of their goods.

Assembly conveyor line at a Chinese factory

There are explanations for this, one of them is the opportunity to open and launch your production according to a ready-made scheme in a very short time and with low costs.

What about cars?

The time when cars from China were like test cars has passed. Now this industry is growing very rapidly, and with it the quality of cars. Now the Chinese car industry is in no way inferior to other manufacturers in comparable classes.

Chinese cars HAVAL

On the roads of any Russian city, you can find a lot of Chinese-made cars, and such popularity indicates the availability and reliability of these cars.

To sum up: is China about quality or not?

Of course, it is impossible to say unequivocally what the quality of the purchased thing will be, because China produces almost all types of goods and does it in huge volumes, but who and under what conditions produces this or that product is another question.

Tag on clothing made in China

A popular myth in our country about low-quality goods with the inscription "Made in China" appeared in the 1990s, it was then that cheap Chinese consumer goods began to appear on the markets of Russia and Europe. Now, serious and high quality control has been established at the factories of China. Any doubts of the quality control department about the product, send the products for reworking. And the success of Chinese companies in the field of mobile development suggests that a lot of attention is paid to the quality of products.

On the website https://china-bazar.com you can order any product from China at an affordable price.

jeans på nätet herr

(jeans på nätet herr, 3. 8. 2021 10:32)

I like reading through an article that can make people think. Also, thanks for allowing for me to comment! jeans på nätet herr olen.prizsewoman.com/map3.php

vad händer om man sover för lite

(vad händer om man sover för lite, 3. 8. 2021 4:36)

Article writing is also a excitement, if you be familiar with afterward you can write otherwise it is difficult to write. vad händer om man sover för lite markti.teswomango.com/map4.php

sport bh med kupor

(sport bh med kupor, 2. 8. 2021 23:13)

I blog frequently and I seriously appreciate your content. The article has truly peaked my interest. I'm going to take a note of your website and keep checking for new information about once per week. I opted in for your RSS feed as well. sport bh med kupor myre.sewomabest.com/map2.php

increase domain rating ahrefs DR from 0 to 50 plus or Maximum

(Eduardorut, 31. 7. 2021 19:42)

Looking for Good quality High authority Backlinks that help to grow Your Ranking ? You are in the right place. and i do offer you best and affordable SEO Backlinks Service , Thanks

You can Try My Service On Ebay here

Special Service available (increasing Ahrefs Domain Ratings Up to 50 plus)

https://www.ebay.com/usr/topseobacklinks

looking for a sponsor

(LolaJef, 31. 7. 2021 19:24)

<img src="https://i.imgur.com/ANxKI85.jpeg">

Good day! Looking for a sponsor. My profile on the search site:

https://datingforkings.club/ My Name: Alisa Lozavarova

Cosmetics

(JoshuaTet, 31. 7. 2021 10:35)

We keep an eye on everything related to fashion in order to constantly be aware of fashion trends and to be able to give our customers the very best products.

The satisfaction and joy of our customers is the first and most important factor in our work. And that's the reason why we continue to focus on shopping excellence.

https://fas.st/YGf8T

Should i buy bitcoin cash reddit

(GarmBava, 27. 7. 2021 16:03)

https://tinyurl.com/yfu24ua7

bitcoin loophole sign up

bitcoin update rate

bitqt kritik

bitcoin blueprint trade calls

bitcoin code espaГ±ol

bitcoin future wiki

bitcoin loophole gulf news

bitcoin pro e contro

looking for a sponsor

(LolaJef, 26. 7. 2021 3:47)

<img src="https://i.imgur.com/ANxKI85.jpeg">

Good day! Looking for a sponsor. My profile on the search site:

https://datingforkings.club/ My Name: Alisa Lozavarova

looking for a sponsor

(LolaJef, 22. 7. 2021 2:30)

<img src="https://i.imgur.com/ANxKI85.jpeg">

Good day! Looking for a sponsor. My profile on the search site:

https://datingforkings.club/ My Name: Alisa Lozavarova

CYBERPOWERPC Gamer Supreme Liquid Cool Gaming PC

(Richardrat, 19. 7. 2021 14:36)https://geni.us/vd7xFr Get the peak of gaming performance with the CYBERPOWERPC Gamer Supreme collection of pc gaming computer systems. The Gamer Supreme series includes monstrous processing power incorporated with the newest and biggest graphics cards to handle even the most requiring video games on the market.

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48

robert gray tarmrening

(robert gray tarmrening, 7. 8. 2021 22:25)